When it came time to sell their home in West Meadows to move into their new home in Estancia, Glenn Schmidt and his wife Gretchen knew they were entering a pretty good local housing market for sellers.

So, when the Schmidts finally listed their home with long-time New Tampa Realtor Kristy Darragh of Florida Executive Realty, they were hoping there was enough interest that they’d at least get their asking price.

On a Friday, the Schmidt’s four-bedroom, three-bath house was officially put up for sale. On Saturday, they had 33 people show up for a showing.

On Sunday morning, there were 22 more scheduled showings by 2 p.m.

“I had to stop setting appointments,” Glenn says. “My phone would not stop blowing up.”

By the end of the weekend, the Schmidts had 15 offers, including two buyers offering to pay in cash, and they eventually accepted a bid well over their asking price.

“We significantly more than doubled what we originally paid for the house,” he says. “It’s one thing to hear that you’re going to do very well when you sell, but then to see (this)? It was ridiculous.”

The Schmidts’ story would have been highly unusual just a year ago. But nowadays, it’s normal.

“This market, it’s a phenomenon,” says Darragh. “It’s mind boggling.”

*****

In Wesley Chapel and elsewhere, the sky seems to be the limit, as soaring prices and sinking inventory make the market a real dogfight.

In our coverage area in Wesley Chapel, which includes zip codes 33543, 33544 and 33545, there were only 60 single family homes listed for sale as of June 24. The median home was a 4BR/3BA, with 2,573 square feet of living space and a listing price of $507,498.

Of those 60 homes, only eight were new construction, and the median price on those was $650,000, or a staggering $246 per square foot.

The 52 resales, with a median size of 4BR/3BA and 2,654 square feet, had a median price of $498,000, or $198 per square foot.

Countywide, the numbers are staggering as well.

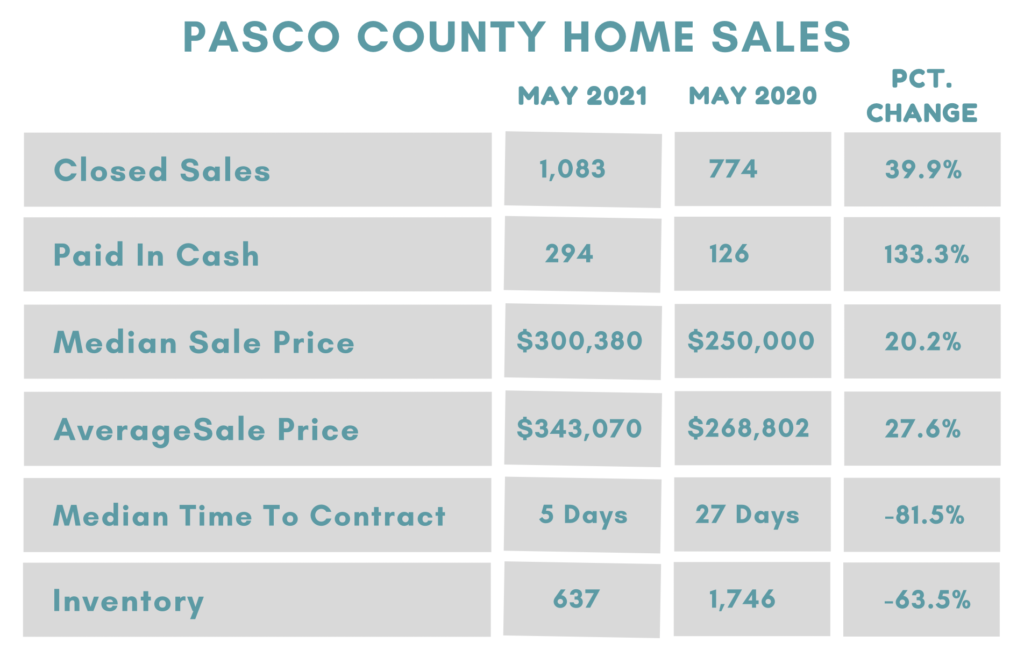

According to the Florida Realtors, the median sale price of all 1,083 houses sold in Pasco County in May was $300,380, a 20.2% increase over the $250,000 median price in May 2020.

Meanwhile, the average price soared to $343,070, a 27% increase from the previous year.

The median time to contract on the homes sold this May was five days, while last year it was 27 days.

Inventory is down to 637 homes, compared with 1,746 last year.

Although Wesley Chapel is a growing housing market with thousands of homes coming along the S.R. 56 extension and in large communities like Epperson, Avalon Park West and the Connected City corridor, builders can’t keep up, hence the lack of inventory.

Combine all of that with historically low interest rates (around 3%) and a massive influx of new residents running away from coronavirus-ravaged states to Florida, which also has friendlier tax policies and “you have a perfect storm,” says local Realtor Chris Henry.

He says that there are 20 or more buyers for almost every house being sold, and anything under $350,000 sells almost instantly, usually for more than the asking price — and often with cash. In fact, 27.1% of sales in May were paid in cash, a number that has increased every month since November 2020, when it was 17.6 percent.

Henry says he recently listed a client’s home for $25,000 more than he normally would have because of the market, and it led to 74 showings over the next two days, resulting in 33 written offers. The house sold for an additional $30,000 over that already-inflated asking price.

“You know, it’s cliché to say, but this is really unprecedented,” Henry says.

Another of Henry’s clients, Noemi Delgado, sold the Riverview townhome she had only lived in for eight months for a $40,000 profit, and turned around and used that money to put down on a new home. “With money to spare,” she says.

Delgado initially planned to live in her townhome for two years before selling but with some prodding from Henry, took a more aggressive approach.

In this market, it might be the only way to succeed.

*****

While traditionally 3-4 months worth of inventory is considered good, the latest numbers say there isn’t even a month’s worth of homes for sale right now. The number currently is 0.6 months supply, meaning that if nothing new came on the market over the next 2-3 weeks, there would be zero houses for sale.

“We are accustomed to low inventory, but I think we are all surprised to see the influx of buyers from out of state coming to the Tampa Bay area,” says Florida Executive Realty Realtor Judi Beck. “To have less than one month of inventory is really uncharted waters.”

The inventory in the Greater Tampa area in April 2020 at the beginning of the pandemic was right around 10,700 homes for sale, with an average selling price of $271,000.

Just 12 months later, inventory was down to just 2,500 homes, but the average sale price had rocketed to $358,000.

In New Tampa, there were only 34 single-family homes listed for sale as of June 11, and 14 of those were asking for more than $500,000 — pricing a lot of first-time buyers out of the market.

Only five homes were listed under $300,000.

For a 3BR/2BA, the prices ranged from a low of $324,900 to $408,000; for a 4BR/3BA, the range was from as little as $307,000 to $1.25 million.

“I think personally, the local people aren’t moving out in as big numbers as the people coming in,” says 17-year real estate veteran Molly Nye, of Century 21 Bill Nye Realty. “There is a supply problem. We’re six months out from this being exciting and frustrating.”

Nye says she is seeing home seekers bidding on empty lots, “which is unheard of.”

It’s a seller’s market, so buyers may need to be more aggressive than usual. The fewer contingencies a buyer has, the more attractive the offer is to the seller, and they typically have many offers to choose from. The seller just needs a place to go once he or she sells. Nye says she has a friend who sold her home to cash out, and is now living with another friend because she can’t find a place to buy.

“She told me that she didn’t think that would happen to her,” Nye says. “I’m seeing a lot more of that.”

*****

In the early- to mid-2000s, a similar boom was instigated by poor lending practices and rampant investor speculation. That led to the average list price in New Tampa, for example, rising from $272,000 in 2003 to $443,000 in 2006.

Then, the real estate “bubble” of 2007-08 popped..

By 2011, the median home in New Tampa was down to $236,000.

Economists and Realtors alike will tell you that this boom is related primarily to the migration of people to Florida, from places like New York, California and all points in between. The ability to work remotely here has been another driving factor. Henry says that four of his last six sales have been to New Yorkers. Because of Covid-19 and the economy, thousands of people each day are leaving states that are not as “open” as Florida, or as tax-friendly, selling their homes and showing up on the doorsteps of local Realtors flush with cash.

Do we risk another real estate bubble/crash reminiscent of 2007-08?

“There is no bubble,” Henry says.

*****

According to Darragh, the New Tampa market is healthy and finally realizing the growth in appreciation it has long deserved.

“The New Tampa market has been undervalued for more than eight years, with a slow growth in appreciation, due to the amount of new construction available,” she says. ”Now that the new construction inventory in Wesley Chapel has come to an abrupt halt, the re-sale market pricing in the New Tampa area has jumped overnight.”

Over the past six months, home prices across the country have risen by 17 percent. Nationally, the typical home asking price in May was $380,000, up 15% from last year.

“Absorption rate is a term used in the real estate industry to describe how fast homes are selling,” Darragh says. “A normal absorption rate for Tampa for the first quarter of this year should have been 40-50% per month. That means that each month, when new listings come on the market, the number of buyers will buy up 40-50% of those new listings. This year, that number is a staggering 179%-200%!”

That means this aggressive absorption rate is sucking up everything that is being built, every new listing that comes on the market, plus the existing inventory of homes. And, as Nye says, even empty lots.

Realtors agree that supply and demand are dangerously out of balance, and question whether this is economically sustainable. The only thing that can slow it down, they say, would be more inventory. However, there’s no indication of an inventory build-up anytime soon.

Henry is convinced that higher interest rates will eventually cause some paralysis. He says it happened in 2018 for a brief period, stopping home owners from selling out of their low mortgage rates and also slowing demand. But, he believes that situation could be at least a year or two away.

“I feel very strongly that in the end, we’ll come in for a soft landing,” Henry says, “but it’s going to take, unfortunately, interest rates increasing and making it impossible for people to buy at 4 or 5 percent. They will be unwilling, and in many cases, unable.”

Darragh has spent hours poring over the data to figure out the current market. Her desk is covered in pie charts and bar graphs, while her computer constantly refreshes to update her on the local housing market in real-time.

With her 30 years of experience selling in the New Tampa area and, with more than $1 billion in sales over that time, she is fascinated looking through her pages of housing statistics. While conventional wisdom says a good seller’s market is bad for buyers, that’s not the case if you are a believer, like she is, that this will continue for another year or two…or longer.

“This market is a once-in-a-generation kind of market, because of what stimulated it (a pandemic),” Darragh says. “It’s a very good market for both buyers and sellers — and people don’t think about it that way — but looking at the charts and listening to real estate experts and economists, they don’t think this is going to end anytime soon. This could be the beginning of something that, in theory, goes on for years.”

The pricing surge has been eye-opening, especially in places like Seminole Heights and South Tampa, but while the urge to cash out may be strong, buyers waiting for a slowdown may be waiting a while.

That’s because, she says, New Tampa is only just now catching back up from the crash of 2007-08.

Based on a Florida Executive Realty “Pent Up Equity” chart, New Tampa’s median home price was $236,000 in 2011, well below the $289,000 it should have been, according to a normal rate of appreciation of 3.5 percent per year.

New Tampa’s median home price is currently up to $380,000, but the normal rate of appreciation says it should be $407,570.

“We haven’t even gotten back to normal yet,” says Darragh. “There’s still plenty of room to run before you even see a bubble.”

That means “deals” can still be found.

In other areas of Tampa, the average “Sold” price far exceeds the price in a market with a normal rate of appreciation. In South Tampa, for example, it’s $175,000 over normal market value; in Carrollwood, it’s $125,000 over; in Seminole Heights, it’s plus-$120,000; and, in Wesley Chapel, it’s almost $100,000 over.

It’s a befuddling market and, while there are plenty of online options to do your home shopping, selecting the right Realtor might be the most important decision you ever make. It is a sentiment strongly echoed by Henry, Beck and Nye, because the market is more complicated and moving faster than ever.

“If you ever needed a local expert, it’s now,” Darragh says.

The post Housing Market Continues To Move Fast appeared first on Neighborhood News.

Customer Reviews

Thanks for submitting your comment!